- Diversity & Impact

- University/MBA

- U.S. Schools - East Coast

- U.S. Schools - Central

- U.S. Schools - West Coast

- Canadian Schools

- Asia-Pacific Schools

- High Schools

- U.S. High Schools: A-G

- U.S. High Schools: H-N

- U.S. High Schools: O-Z

- …

- Diversity & Impact

- University/MBA

- U.S. Schools - East Coast

- U.S. Schools - Central

- U.S. Schools - West Coast

- Canadian Schools

- Asia-Pacific Schools

- High Schools

- U.S. High Schools: A-G

- U.S. High Schools: H-N

- U.S. High Schools: O-Z

- Diversity & Impact

- University/MBA

- U.S. Schools - East Coast

- U.S. Schools - Central

- U.S. Schools - West Coast

- Canadian Schools

- Asia-Pacific Schools

- High Schools

- U.S. High Schools: A-G

- U.S. High Schools: H-N

- U.S. High Schools: O-Z

- …

- Diversity & Impact

- University/MBA

- U.S. Schools - East Coast

- U.S. Schools - Central

- U.S. Schools - West Coast

- Canadian Schools

- Asia-Pacific Schools

- High Schools

- U.S. High Schools: A-G

- U.S. High Schools: H-N

- U.S. High Schools: O-Z

Do You Have An Affinity For Investing In Latin American Companies And/Or Globally?

Join Bonded By Latin America to start receiving high quality Latin American and global investment opportunities across venture capital and private equity.

Bonded By Latin America is part of Bonded - VU's Affinity Investor Network, where investors select their preferences for the types of opportunities they want to receive and gain the benefits of investing alongside a professionally managed top tier fund.

VU's Investment Managers Were Some Of The Earliest & Largest Investors In 20+ Unicorns, Now Valued At $1B+

Bonded Gives You Access To Invest With VU & Other Top Tier Funds

Benefits Of Investing With Bonded

Select Your Preferences For The Types Of Investment Opportunities You Want To Receive Across Venture Capital Verticals, Private Equity Sectors, Diversity/Impact, Geography, & Universities

No Membership Fees

There Are No Monthly Or Annual Membership Fees For Joining & Receiving Investment Opportunities

Invest On A Deal-By-Deal Basis or In Committed Focused Funds

Invest As Little As:

- $5K+ per Deal

- $50K+ per VC Vertical Focused Fund or PE Sector Focused Fund

- $500K+ per Diversified Venture Fund Or Diversified Private Equity Fund

Get Access To The Full Spectrum Of The VC/PE Asset Class

Be As Diversified Or Concentrated As You Want In Terms Of Risk & Return Across Stage, VC Verticals, PE Sectors, & Geographies

Participate On Q&A Investor Calls

Our Investment Team Will Share The Due Diligence Completed & Investment Thesis On Each Opportunity

Professionally Managed By A ~70+ Person Investment Team Across Venture Capital & Private Equity

10x Larger Than An Avg. Investment Team

20,000+ Opportunities Sourced & Reviewed Per Year

10x More Deal Flow Than An Avg. Investment Fund

Receive Our Top ~25 Opportunities To Consider Investing In Each Year

A ~0.1% Selectivity, 10x More Selective Than An. Avg. Investment Fund At ~1%

Senior Investment Partners Have 65+ Years Of Investment Experience

Across All Venture Capital Verticals & Private Equity Sectors

Top Tier Performance: 72% IRR (2018-2021) Across 70+ Companies

Benchmarked As A ~97% Top Performing Fund

Venture Capital Verticals

Invest in companies within certain verticals, each targeting a ~10-100x+ return within ~5-10 years

Private Equity Sectors

Invest in private equity opportunities with lower risk, shorter time horizons, and some of which provide cash flow distributions such as real estate and leveraged buyouts.

Real Estate

Target Return:

~1.5-3x Over ~3-7 Years

Leveraged Buyouts

Target Return:

~2-10x Over ~3-7 Years

PIPEs

Target Return:

~2-5x Over ~1-3 Years

Pre-IPOs

Target Return:

~2-7x Over ~1-3 Years

Growth Equity

Target Return:

~3-10x Over ~3-5 Years

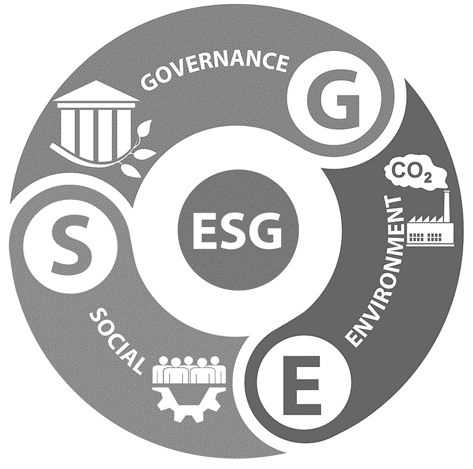

Diversity & Impact

Invest in companies with diverse teams, diverse investors, and an ESG impact focus

Women Founders & Investors

Black Founders & Investors

Latinx Founders & Investors

LGBTQ+ Founders & Investors

Impact Investing

Bonded © 2025